Estimating the cost of preparing your tax return

Our pricing is based on the overall complexity of your tax return. Because every taxpayer’s situation is unique, we cannot determine your exact preparation fee until we have reviewed and interpreted all of your tax documents. However, we can provide a general estimate using the fee ranges and examples outlined below.

Please take time to review the information on this page to ensure you are comfortable with our pricing structure before scheduling an appointment. A retainer will be collected when you book your appointment or when you submit your tax documents to us.

Typical fee ranges for returns we prepare

-

Simple returns (described in Examples 1, 2, 3 and 4 below) usually cost $700 - $1,200 to prepare.

-

Average returns (described in Examples 5 and 6 below) usually cost $1,200- $1,800 to prepare.

-

Complex returns (described in Examples 7, 8, 9 10 & 11 below) usually cost $1,800 - $3,000+ to prepare.

-

Tax returns with multiple rental properties, businesses, multiple states, foreign income or other complexities usually cost $3,000+ to prepare.

How our pricing works

Our fees are based on the complexity of your tax return. In general:

We charge a fixed fee for each tax form and worksheet required to prepare your return.

Certain items—such as stock sales or depreciation entries—may include a per‑item charge.

We charge $10 per income document, including:

- W‑2

- 1099‑R

- Social Security statements

- 1099‑INT

- 1099‑DIV

Tax research is billed at $350 per hour, in addition to standard form‑based fees.

Receipt add‑up, organization, or accounting services are billed at $350 per hour, in addition to standard form‑based fees.

Situations that can impact the pricing of returns

Several factors can increase the complexity of your tax return and may affect your total preparation fees:

-

Local Income Taxes (PFA & SHS): If your income exceeds $125,000 (or $200,000 if married) and you reside in Metro or Multnomah County, you may be required to file and pay:

- Multnomah County’s Preschool for All (PFA) tax

- Metro’s Supportive Housing Services (SHS) tax

-

High‑Income Federal Taxes: If your income exceeds $200,000 (or $250,000 if married), you may owe additional federal taxes that require:

- Form 8959 (Additional Medicare Tax)

- Form 8960 (Net Investment Income Tax)

- Dependents, Education, and Childcare: Claiming dependents or reporting college tuition, education credits, or childcare expenses requires additional forms. See Example 3 below.

- Sales, Investments, and K‑1 Income: Reporting the sale of a home, sale of stock, or K‑1 income from a partnership, S corporation, trust, or estate requires additional forms. See Example 6 below.

- Foreign Financial Accounts: If you hold more than $10,000 in foreign financial accounts, you must report these accounts. See Example 11 below.

- Income From Another State: If you earned income in a state other than Oregon, additional state filings may be required. See Example 9 below.

Individual Tax Return Preparation Fees

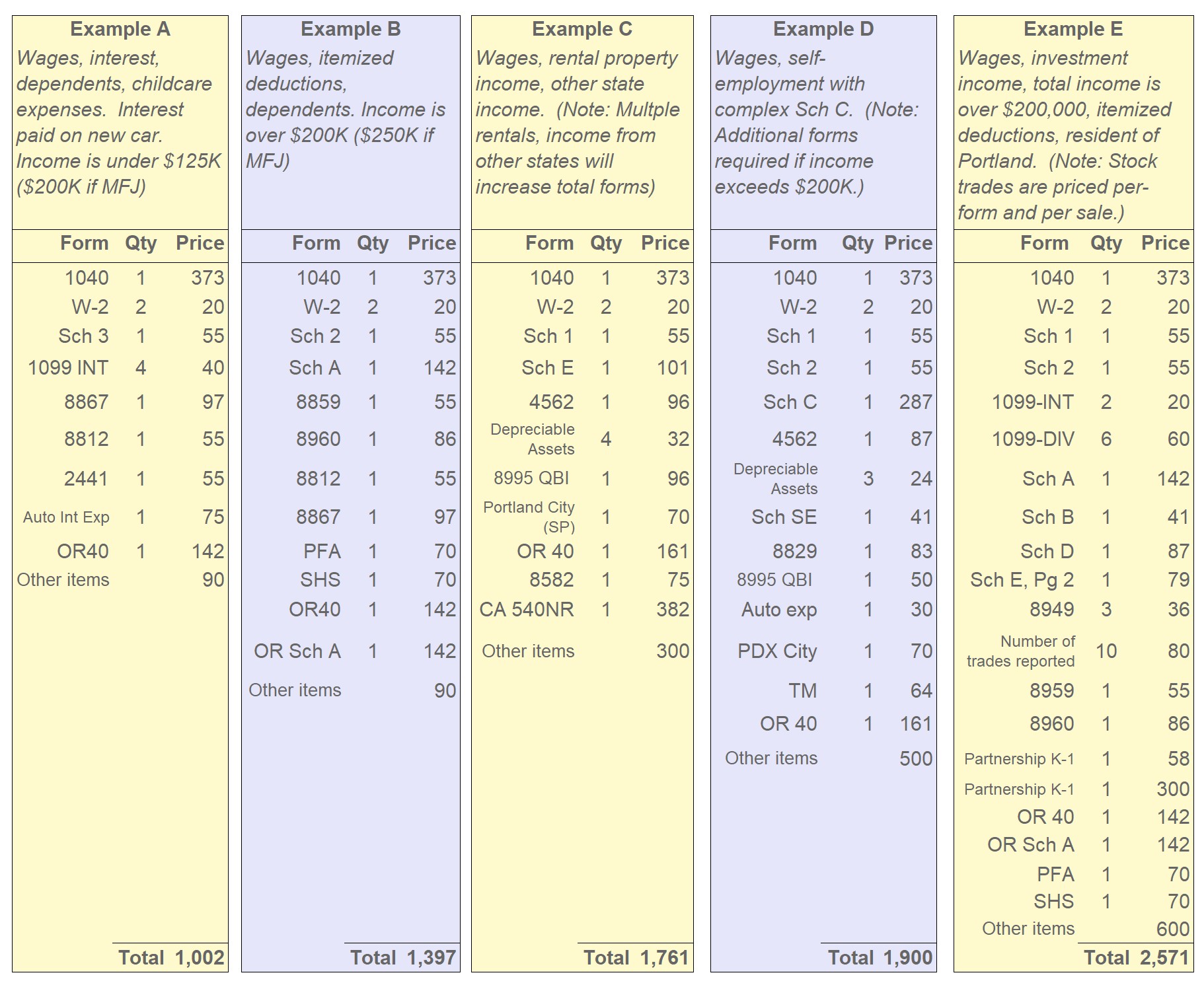

Examples of how some tax returns can price out are as follows:

(Note: If you are viewing from your smart phone, turn screen sideways to see full pricing table below.)

Tax Return includes the following income and deductions |

Forms Required |

Total Average Price Charged |

Example 1: 1040 Simple return with wage, retirement, interest or dividend income.

Important Note About High‑Income Filers If your gross income is above $125,000 (Single or Married Filing Separately) or $200,000 (Married Filing Jointly), your return will move into the high‑range pricing tier due to required filings for:

These local taxes add complexity and additional forms to your Oregon return. We recommend you see our What to Bring page and review our Individual 1040 Tax Organizer to help you prepare for your tax interview. |

Low: You have income only from wages. Average: You have income from retirement, wages, interest or dividends. Interest and dividends are under $1,500. Please add $10 for each income statement that you have. High: your return will push into the high range if your interest/dividend income is more than $1,500, you have several W-2s, 1099Rs, 1099 INTs or 1099 DIVs, or if you have certain types of income or deductions that require additional forms on your Oregon return. If you have other sources of income, you should look to examples on this page for these types of income.

|

Low $700 to $800

Average $800 to $1,000

High $1,000+

|

Example 2: 1040 Simple Return with Dependents, EIC, ACTC, and CDCC

We recommend you see our What to Bring page and review our Individual 1040 Tax Organizer to help you prepare for your tax interview. |

1040, W-2 x 2, 8812, EIC, 8867, Form 40, 2441 | $875 - $1,200 |

Example 3: Simple return with dependents or college education expenses

We recommend you see our What to Bring page and review our Individual 1040 Tax Organizer to help you prepare for your tax interview. |

Low

Average

High

|

Low $900 to $1,000

Average $1,000 to $1,300

High $1,300+ |

Example 4: 1040 itemized deductions

Out-of-state returns We recommend you see our What to Bring page and review our Individual 1040 Tax Organizer to help you prepare for your tax interview. Home Sale: Did you sell your home during the year?

Was your home used as a rental property?

|

Low: Your income is from wages only, and

Average:

High:

See Example 11 if you have income from a state other than Oregon |

Low $1,000

Average $1,000 to $1,200

High $1,200+ |

Example 5: Stock Sales, Investment Income, or K‑1 ReportingThis example builds on the same facts as the Low tier (wages + simple stock sales), with additional investment‑related income or pass‑through income. Possible income sources include:

Jurisdictions: Federal + Oregon Additional Forms Triggered by Investment or K‑1 Income If you received a K‑1, the following applies:

Foreign Investment or Financial Accounts If you have foreign accounts or investments subject to FATCA or FBAR reporting:

Preparing for your interview - We recommend you see our What to Bring page and review the following tax organizers to help you prepare for your tax interview:

|

Low:

Average:

High:

|

Low $1,000 to $1,200

Average $1,200 to $1,800

High $1,800- $3,000+

|

Example 6: Rental property

If you own more than one rental property:

Preparing for your interview - We recommend you see our What to Bring page and review the following tax organizers to help you prepare for your tax interview: |

Low:

Average:

High:

|

Low $1,200

Average $1,400 to $2,000

High $2,000 - $3,000+ |

Example 7: Self Employment/Business IncomePrice varies based on:

Jurisdictions: Federal + Oregon If you performed services or operated your business in any of the following areas, additional local returns must be filed:

These filings add complexity and may increase the preparation fee. Preparing for your interview - We recommend you see our What to Bring page and review the following tax organizers to help you prepare for your tax interview: |

Simple Schedule C:

Average Schedule C:

High Schedule C:

|

Low $1,800-$2,500

Average: $2,500- $3,500

High: $3,500+ |

|

Example 8: Amended tax return Our fee for preparing an amended return depends on whether we prepared the original return and the complexity of the corrections required. Amended returns vary widely, and pricing reflects the additional schedules, reconciliation, and review work involved. Pricing is generally similar to what we would have charged to prepare the original return, plus the additional forms required for the amendment. Preparing for your interview - We recommend you see our What to Bring page and review our Individual 1040 Tax Organizer to help you prepare for your tax interview. In addition, bring a copy of the original return, and copies of any IRS or State letters pertaining to the tax year in question. |

If we prepared the original return but you did not provide complete or accurate information, we charge for the additional forms and schedules required to correct the return. Common situations include:

If another firm or software prepared the original return, our fee for amending will depend on:

|

We prepared the original return but you failed to provide all relevant information: $600-$1,000+ We did NOT prepare the original return: $1,000 - $2,000+ |

Example 9: Out-of-State ReturnsIf you earned income in more than one state, you may be required to file multi‑state tax returns. Because these filings involve residency rules, income allocation, and differing state tax laws, we consider multi‑state returns to be complex. We recommend scheduling with an experienced preparer. Fees for state returns are billed in addition to the federal return fees and examples listed previously. If you are itemizing on your state return, please add $142 for preparation of the state Schedule A. Preparing for your interview - We recommend you see our What to Bring page and review our Individual 1040 Tax Organizer to help you prepare for your tax interview. In addition, bring copies of your prior-year State and Federal returns. |

We prepare returns for all states, as well as U.S. territories. We also have experience preparing returns for CNMI, Guam, and other U.S. territories. For Puerto Rico, we recommend working with an EA located in Puerto Rico, as the SURI filing system is Spanish‑language only and can be difficult for non‑Spanish speakers to navigate. |

Oregon: $332 State Sch A: $142 AR, AZ, CO, CT, DE, GA, HI, IL, NE, PA, SC, & UT: $146 per state CA, VA, MA, MD, NJ, & NY: $350 per state All other states: $133 State city/county returns: $70 |

Example 10: Nonresident Returns (1040NR)Dual‑status residents and U.S. nonresidents with U.S.‑source income may be required to file Form 1040‑NR. In some situations, a nonresident may elect to file Form 1040 instead. Because these filings involve unique rules, treaty considerations, and residency determinations, we recommend scheduling with a staff member experienced in nonresident taxation. Preparing for Your Interview To ensure an efficient and accurate appointment, please bring:

These documents help us determine your residency status, treaty eligibility, and correct filing requirements. |

Low Complexity

Average Complexity

High Complexity

|

Low $1,000 Average: $1,000 - $1,500 High: $1,500 - $2,000+ |

Example 11: Foreign incomeYou may have foreign income if any of the following apply:

U.S. taxpayers are required to report worldwide income. You may be eligible to reduce or offset foreign income through the Foreign Earned Income Exclusion, the Foreign Tax Credit, or certain travel‑related deductions. If these benefits do not apply, we will help you determine the most accurate and tax‑efficient reporting method. Pricing for returns that include foreign income follows the structure below and reflects the additional forms, schedules, and reporting requirements associated with foreign income. Offshore Stream-Lined Filing Compliance Procedures We also prepare specialized filings for expatriates and individuals who are out of tax‑filing compliance and wish to come into compliance using the IRS Offshore Streamlined Filing Compliance Procedures. These filings involve multi‑year amended returns, FBAR filings, FATCA reporting, and non‑willfulness certification. Preparing for your interview - We recommend see our What to Bring page and review the following organizers to help you prepare for your tax interview: |

Low:

Average:

High:

|

Low $1,000 Average: $1,500-$2,000 High: $2,500- $3,000+ Specialized situations like offshore streamlined compliance procedures or controlling interest of foreign corporations run $5,000 - $12,000+ |

|

Example 12: Specialized International Compliance Services Certain international tax matters require extensive analysis, multi‑year filings, and detailed documentation. Our pricing reflects the level of expertise, coordination, and care required to prepare accurate and defensible filings. Streamlined filings are designed for taxpayers who need to correct multiple years of foreign reporting. This service involves significant review, multi‑year corrections, and preparation of all required foreign reporting forms. Form 5471 is one of the most complex filings in the U.S. tax system and requires detailed financial and ownership reporting. Pricing is per entity and reflects the depth of analysis and documentation required. Preparing for your interview - We recommend see our What to Bring page and review the following organizers to help you prepare for your tax interview: |

Offshore Streamlined Compliance Procedures may include:

Controlling Interest in a Foreign Corporation (Form 5471) preparation may include:

|

Offshore Streamlined Compliance Procedures:

Controlling Interest in a Foreign Corporation (Form 5471): |

Partnerships, LLCs, Corporations, S-Corporations, Estates & Trusts

Fees for preparing corporate and partnership returns vary, according to the complexity of the tax return. Please see our Business & Entity Return Pricing page for information on how we price these types of returns.

Oregon Laws Governing Pricing Disclosure

Oregon Licensing Laws governing advertising and pricing state:

"No licensee shall give or offer to give a discount unless:

The discount is based upon a conspicuously posted basic fee schedule at the licensee's place of business; and

The fees on the posted basic fee schedule are the usual and customary charges of the business; and

The posted basic fee schedule is made available to the general public."

The purpose of this rule is to ensure income tax services who advertise discounts to attract customers fairly and openly disclose their pricing.

In accordance with these laws, Pacific Northwest Tax Service makes every effort to openly and fairly disclose our pricing. We believe it is the responsibility of all licensed tax professionals to adhere to the Code of Conduct set forth by the Oregon Board of Tax Service Examiners. Tax Board's rules governing the conduct for tax professionals in Oregon.

Oregon law requires tax preparers who offer discounts or coupons to post their price schedule. Ask to see your preparer's price schedule to ensure you are being fairly charged.