In 2021, Congress passed the Corporate Transparency Act on a bipartisan basis. This law creates a new beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

The Corporate Transparency Act (CTA) plays a vital role in protecting the U.S. and international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug trafficking, and money laundering. The CTA levels the playing field for tens of millions of law-abiding small businesses across the United States and makes it harder for bad actors to exploit loopholes in order to gain an unfair advantage.

BOI Reporting is Completed on the FinCEN Website

FinCEN is the Financial Crimes Enforcement branch of the United States Treasury Department.

BOI reporting is NOT carried out by the IRS and is NOT sent to BOI when you file a tax return with the IRS. If you are required to register your business with FinCEN, you must do so directly on the FinCEN website at Beneficial Ownership Information Reporting | FinCEN.gov.

Who is Required to Report Information to BOI?

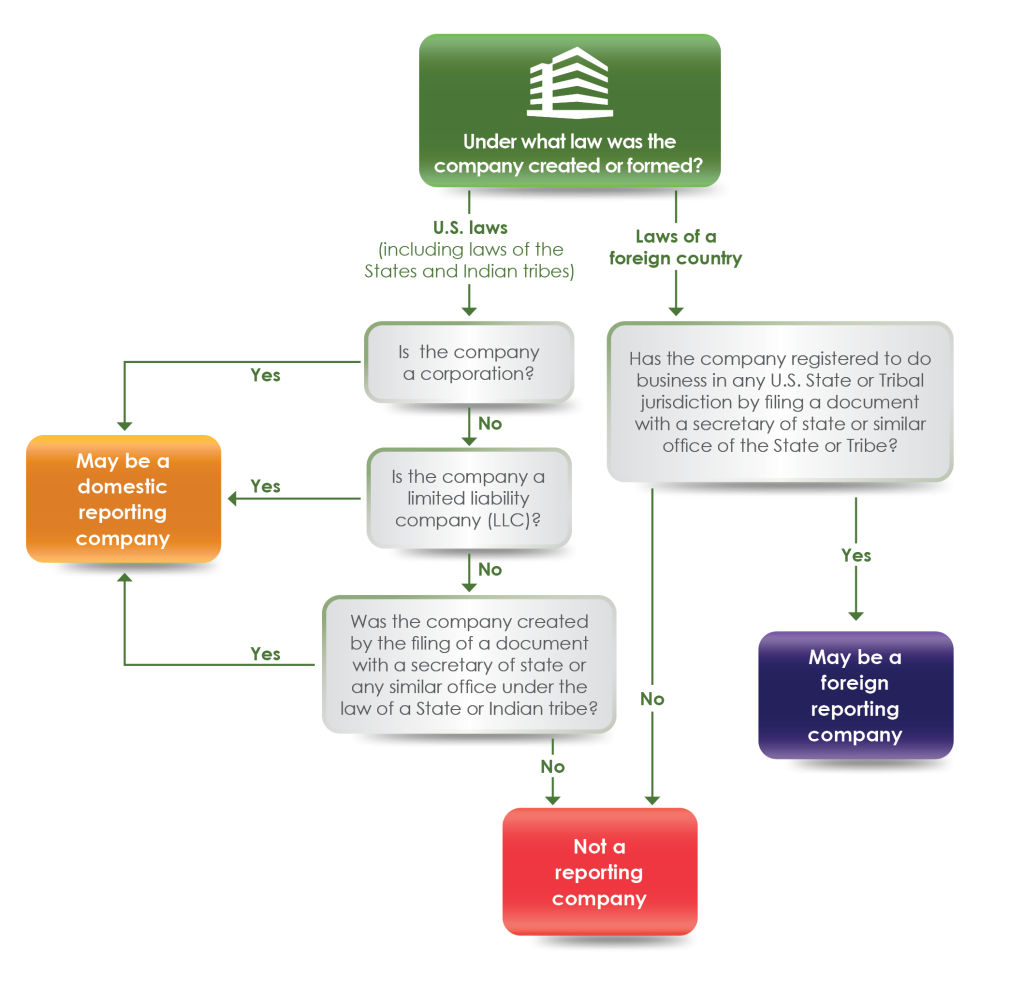

Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the United States must report information about their beneficial owners—the persons who ultimately own or control the company—to FinCEN beginning on Jan. 1, 2024.

If you are a company required to report, the initial beneficial ownership information reporting is based on the date your company receives actual notice that its creation or registration is effective, or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier.

FinCEN FAQs

FinCEN FAQs

Questions such as will my company be required to report beneficial ownership information to FinCEN, who is a beneficial owner, and when do I need to report my company's beneficial ownership information are found on FinCEN's website.

What Information Must be Reported?

FinCEN launched the BOI E-Filing website for reporting beneficial ownership information (https://boiefiling.fincen.gov) on January 1, 2024.

- A reporting company created or registered to do business before January 1, 2024, will have until January 1, 2025, to file its initial BOI report.

- A reporting company created or registered in 2024 will have 90 calendar days to file after receiving actual or public notice that its creation or registration is effective.

- A reporting company created or registered on or after January 1, 2025, will have 30 calendar days to file after receiving actual or public notice that its creation or registration is effective.

Reporting Requirement is Temporarily Suspended Due Court Order

In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports.