Congratulations on the purchase of your new home! You may be eligible to claim tax deductions and credits, which will save you tax dollars.

You are entitled to claim deductions for the mortgage interest and real estate taxes you paid on your home. You may also qualify to claim a tax credit if you installed solar panels on hour home. There is no separate organizer for new home purchases, however we will need you to bring the following documents to your tax interview:

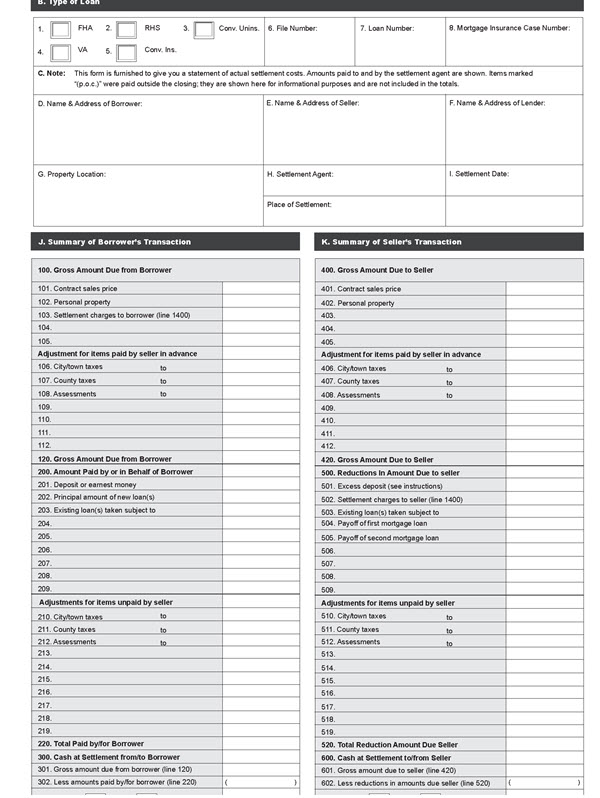

- Settlement (HUD) Statement showing the closing costs you paid. Click link below to see an example of a HUD statement.

- Form 1098 - Mortgage Interest Paid. If you refinanced, have a second mortgage or your mortgage was transferred to another lender, you will receive more than one form.

- Amounts and payment dates for real estate taxes you paid on your home. If your taxes are paid through your mortgage company, taxes paid may appear on the Form 1098 you receive.

- Receipts for solar panels you installed on your main or second home during the year.

- If you installed a new furnace, air conditioner or made energy efficiency improvements to your home, Oregon may allow you a residential energy credit. For more information, see our Client Resources page.